Mileage Log Requirements . — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. irs mileage log requirements. — key takeaways. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. Are you required to keep. The irs allows taxpayers to claim deductions for the use of a vehicle. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. — get an overview of mileage log requirements by the irs or your employer. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending.

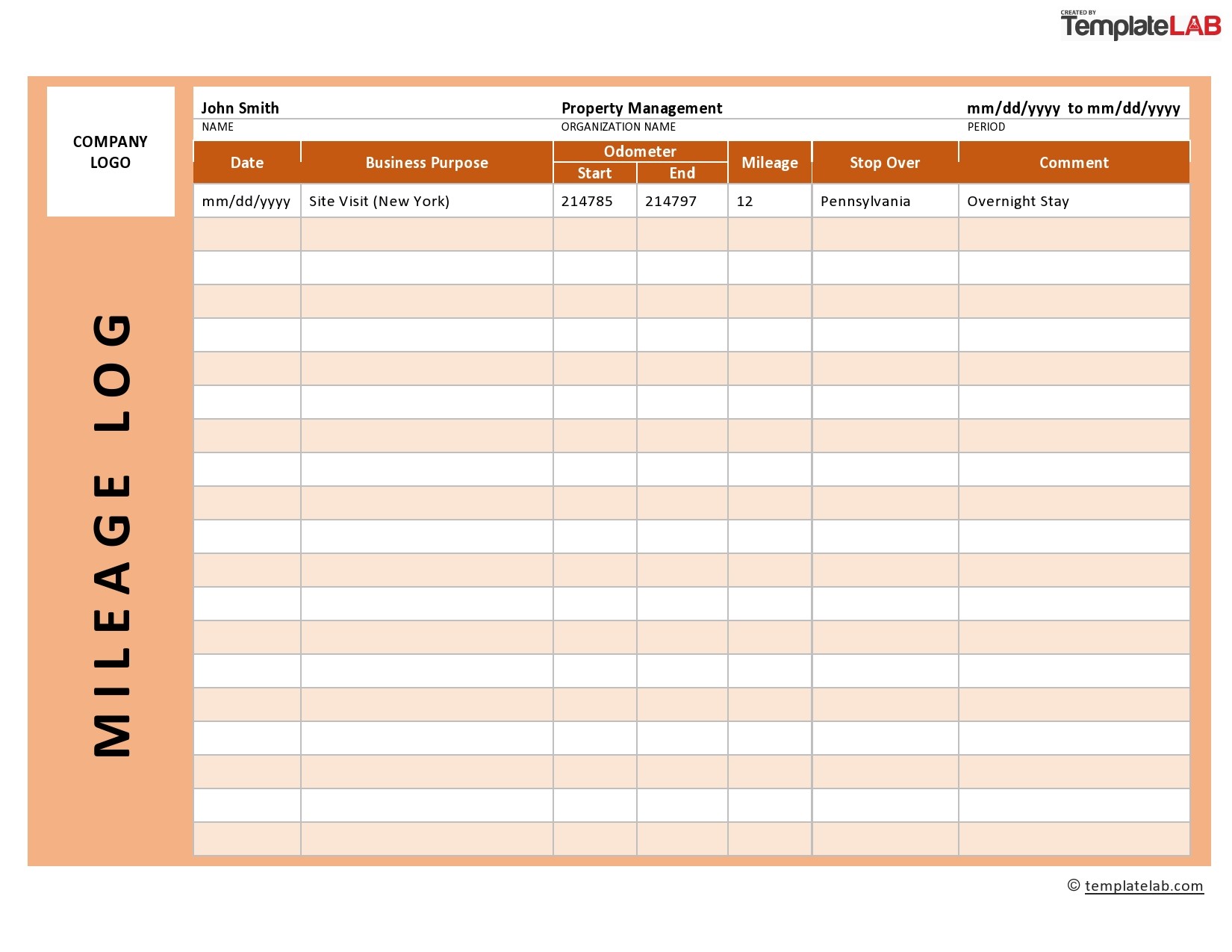

from templatelab.com

if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. — key takeaways. The irs allows taxpayers to claim deductions for the use of a vehicle. — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. — get an overview of mileage log requirements by the irs or your employer. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. irs mileage log requirements. Are you required to keep.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Mileage Log Requirements The irs allows taxpayers to claim deductions for the use of a vehicle. The irs allows taxpayers to claim deductions for the use of a vehicle. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. Are you required to keep. — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. — key takeaways. irs mileage log requirements. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. — get an overview of mileage log requirements by the irs or your employer.

From www.mileagewise.com

IRS Mileage Log Requirements The Definitive Guide Mileage Log Requirements The irs allows taxpayers to claim deductions for the use of a vehicle. Are you required to keep. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage,. Mileage Log Requirements.

From templatelab.com

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage Log Requirements — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. In order to properly track mileage for tax purposes, the irs. Mileage Log Requirements.

From www.smartsheet.com

Free Mileage Log Templates Smartsheet Mileage Log Requirements In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. The irs allows taxpayers to claim deductions for the use of a vehicle. . Mileage Log Requirements.

From www.getwordtemplates.com

7+ Vehicle mileage log Templates Word Excel PDF Formats Mileage Log Requirements — get an overview of mileage log requirements by the irs or your employer. — key takeaways. Are you required to keep. irs mileage log requirements. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. In order to properly track mileage for tax. Mileage Log Requirements.

From www.mileagewise.com

IRS Mileage Log Requirements The Definitive Guide Mileage Log Requirements — get an overview of mileage log requirements by the irs or your employer. irs mileage log requirements. The irs allows taxpayers to claim deductions for the use of a vehicle. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. — key takeaways.. Mileage Log Requirements.

From www.doctemplates.net

25 Free Mileage Log Templates (Excel Word PDF) Mileage Log Requirements — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. — get an overview of mileage log requirements by the irs or your employer. The irs allows taxpayers to claim deductions for the use of a vehicle. — keeping an accurate mileage log ensures you. Mileage Log Requirements.

From templatelab.com

30 Printable Mileage Log Templates (Free) Template Lab Mileage Log Requirements if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. In order to properly track mileage for tax purposes, the irs has a short,. Mileage Log Requirements.

From www.sampletemplates.com

13 Sample Mileage Log Templates to Download Sample Templates Mileage Log Requirements Are you required to keep. irs mileage log requirements. — key takeaways. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year. Mileage Log Requirements.

From templatelab.com

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage Log Requirements irs mileage log requirements. The irs allows taxpayers to claim deductions for the use of a vehicle. Are you required to keep. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. — keeping an accurate mileage log ensures you can maximize. Mileage Log Requirements.

From templatelab.com

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage Log Requirements — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. — key takeaways. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. irs mileage log requirements. — your mileage log must include the. Mileage Log Requirements.

From templatelab.com

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage Log Requirements — key takeaways. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. — your mileage log must include. Mileage Log Requirements.

From www.pdffiller.com

Printable Mileage Log Pdf Fill Online, Printable, Fillable, Blank Mileage Log Requirements — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. The irs allows taxpayers to claim deductions for the use of a vehicle. irs mileage log requirements. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person. Mileage Log Requirements.

From handypdf.com

2024 Mileage Log Fillable, Printable PDF & Forms Handypdf Mileage Log Requirements — get an overview of mileage log requirements by the irs or your employer. — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. if. Mileage Log Requirements.

From www.gofar.co

25 Printable IRS Mileage Tracking Templates GOFAR Mileage Log Requirements if you use your personal vehicle to conduct business and plan to take tax deductions on your mileage, or you’re an employee getting reimbursed, it’s. Are you required to keep. — get an overview of mileage log requirements by the irs or your employer. — key takeaways. irs mileage log requirements. The irs allows taxpayers to. Mileage Log Requirements.

From templatelab.com

30 Printable Mileage Log Templates (Free) Template Lab Mileage Log Requirements Are you required to keep. — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. — key takeaways. The irs allows taxpayers to claim deductions for the use of a vehicle. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of. Mileage Log Requirements.

From www.sampletemplates.com

Mileage Log Template 14+ Download Free Documents In Pdf,Doc Mileage Log Requirements — keeping an accurate mileage log ensures you can maximize your deductions while complying with irs mileage log requirements. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. if you use your personal vehicle to conduct business and plan to take tax deductions on. Mileage Log Requirements.

From www.youtube.com

The easiest way to keep a mileage log for tax deductions YouTube Mileage Log Requirements The irs allows taxpayers to claim deductions for the use of a vehicle. irs mileage log requirements. — get an overview of mileage log requirements by the irs or your employer. In order to properly track mileage for tax purposes, the irs has a short, but strict set of rules that every person must. — your mileage. Mileage Log Requirements.

From printableformsfree.com

2023 Mileage Reimbursement Form Printable Forms Free Online Mileage Log Requirements The irs allows taxpayers to claim deductions for the use of a vehicle. — your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending. — key takeaways. — get an overview of mileage log requirements by the irs or your employer. Are you required to keep.. Mileage Log Requirements.